Backed by the general crypto market gains and increasing investor interest in meme coins launched on the Solana (SOL) blockchain, the network’s native token has registered stellar performance in the current rally.

Indeed, SOL investors are anticipating the next price movement that could pave the way for a potential record high above the $200 mark, as the community remains super bullish.

Notably, the growth in SOL prices has coincided with a significant on-chain movement of the token. Particularly, data provided by Whale Alert on March 29 indicates that 1,757,028 SOL tokens worth approximately $332 million were moved between unknown wallets.

It’s worth noting that the significant transfer of SOL tokens has the potential to impact the valuation of the token in either direction. For instance, in cases where there are large movements of selling, it increases the supply, potentially lowering prices, while holding reduces the supply, potentially raising prices.

What next for Solana?

When looking at the next Solana price, besides the whale activity, the token is influenced by several elements. Currently, SOL is consolidating below the $200 mark, with a section of analysts pointing out that the token can potentially move in either direction.

Particularly, crypto trading analyst Trading Shot pointed out that SOL can potentially retrace to $155 or hit a new record high of $310. His projection is based on technical analysis, where he observed that SOL was trading within a triangle pattern in the one-day time frame.

In the March 29 analysis, he pointed out that the one-day moving average (MA) of 50 has provided consistent support since late September 2023, with only a brief break occurring for four days in late January 2024 during the previous similar channel-up phase.

“That Channel Up also formed a Triangle half-way through and when the price broke to the upside, it peaked on its 1.5 Fibonacci extension. As a result, we will buy in case a similar bullish break-out takes place and target $310. If the Triangle breaks to the downside first though, we will short and target the 1D MA50 at $155,” he said.

In the meantime, Solana is likely to be swayed by activities related to the collapsed FTX crypto exchange. Notably, the management of the bankrupt trading platform will sell its balance of 41 million in Solana to institutional investors at around a $60 discount. Indeed, SOL is likely to be swayed once the tokens hit the market.

Solana outshines Ethereum

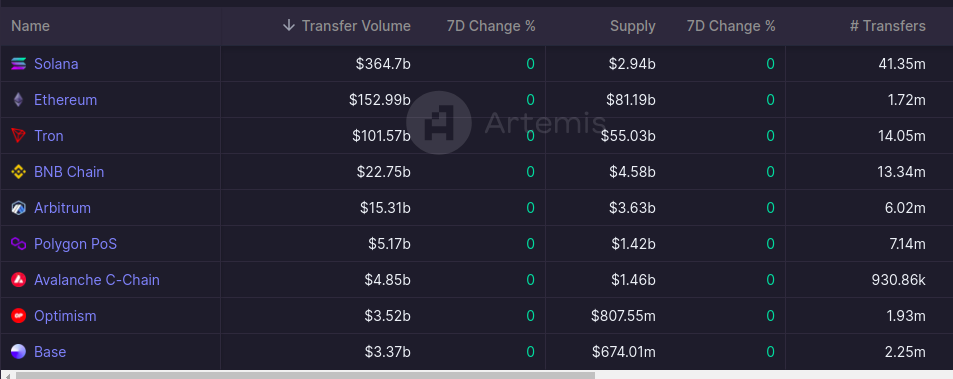

Furthermore, on-chain metrics point to a bullish Solana price outlook. Specifically, data from the blockchain analytics platform Artemis indicates that as of March 30, Solana’s weekly transfer volume for stablecoins surged to $364.7 billion, surpassing Ethereum’s (ETH) reported volume of $152.99 billion.

This metric bodes well with Solana’s aspiration to emerge as a possible competitor to Ethereum as a decentralized finance (DeFi) platform.

Elsewhere, it will also be interesting to monitor how the upcoming Solana Saga smartphone will play out. The token’s rally was partly attributed to the demand for the first version of the device, which has been touted as crypto-friendly.

SOL’s bearish fundamentals

Additionally, Solana faces several headwinds regarding its potential march to a new all-time high. For instance, the network has faced perennial concerns about outages that might deter developers.

At the same time, with the meme coins launched on the platform acting as key catalysts, there is a call for caution, considering that such tokens typically have no underlying fundamentals and are likely to see corrections.

Meanwhile, by press time, Solana was trading at $196 with daily gains of almost 7%. On the weekly chart, SOL is up 12%.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.