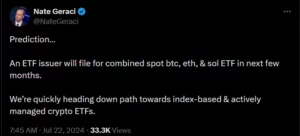

In a social media post on X (formerly Twitter), Nate Geraci, president of The ETF Store, predicted that one of the ETF issuers will most likely apply for a combined spot ETF of three main assets in the crypto industry, Bitcoin (BTC), Ethereum (ETH) and Solana (SOL) in the next several months. Growing investor demand for diverse exposure to cryptocurrency ETFs is solid. Geraci further commented that a new index-based approach and actively managed crypto assets are what investors need from their crypto asset managers.

Win-Win For Both Investors and Regulators:

Retail investors can benefit from funds such as Bitcoin, Ethereum, and Solana, giving them the advantage of being diversified across coins inside a single ETF. This diversification lowers risk because investments are distributed among competent digital assets, and the volatility of separate cryptocurrencies is minimized. Moreover, a composite ETF simplifies the funding course of loads for retail buyers as they do not want to handle multiple separate crypto holdings. A single ETF can pool several cryptocurrencies into one product, allowing costs to be spread and investors to save on transaction fees and the costs of investing in different cryptos. On the other hand, actively managed funds provide the benefits of having their assets professionally deliberated and allocated and being able to act swiftly when adjusting in response to changes. This can effectively reduce risk by spreading it across various assets, as the gains from one will help to offset losses in others and thus give rise to more consistent returns.

An ETF that combines Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) would be highly beneficial for retail investors and the overall financial market from a regulatory standpoint. Since ETFs are regulated investment products that offer oversight and protection, they are not usually available through direct cryptocurrency investments. Second, the product encourages diversification by bundling multiple cryptocurrencies into a single ETF, another regulatory cornerstone in lessening systemic risk. It reduces volatility and potential losses related to individual assets, which results in better system stability. Regulators prefer these mechanisms because they fit neatly under regulatory objectives around orderly and efficient markets.

There is no update on a combined spot ETF yet, but with the rate at which these crypto-backed ETFs are gaining popularity among financial markets, that could change soon. For a combined spot ETF, the motion (and less regulation) seems more favorable for regulators and investors.