Dennis Diatel Photography

Dennis Diatel Photography

Though Solana (SOL-USD) is named after a beach, life at SOL has been ANYTHING but a beach. Like all projects, Solana suffered from the 5/2022 TerraUSD stablecoin crash and the associated decline in the Terra (LUNA-USD) ecosystem. However, the hit to Solana during the 11/2022 FTX (FTT-USD) blowup was considerably worse than its peers. Below I highlight the numerous ways Solana was uniquely affected by the FTX event and then show how the Solana ecosystem has pivoted away from Defi towards NFTs and the consumer market. This pivot is being aided by Solana’s innovate technologies, several of which will go live in 2024. Before proceeding, I give a summary of my Ratings Scorecard for Solana as I see a dire need for a holistic fundamental analysis that’s currently not being utilized.

The soul of Solana is Anatoly “Toly” Yakovenko, who co-created the project while working at Qualcomm. Toly was trading on the side and figured there could be a better way of trading quicker and on a level playing field with professionals. So in 2017, Toly organized a group of Qualcomm colleagues and friends to find a better solution (Whitepaper). Solana is a monolithic, Beta-staged, non-EVM designed L1, third-generation, smart-contract protocol developed to enhance network scalability and performance through its novel Proof-of-History (PoH) technology. Yes, that’s a mouthful!

Below I highlight the key technologies that will power the project into 2024 and help mitigate regulatory risks.

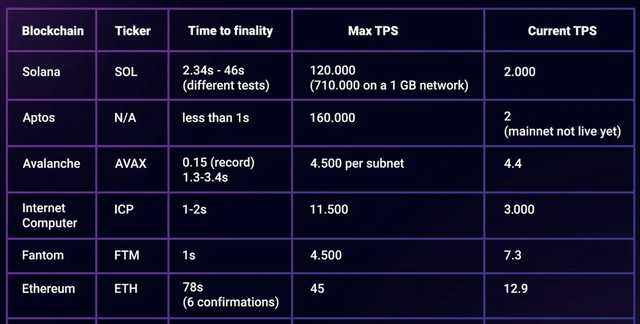

Pontem Network

Pontem Network

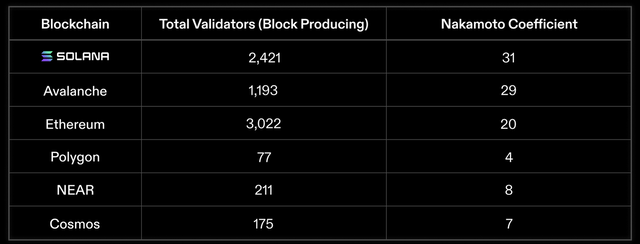

Solana Foundation

Messari

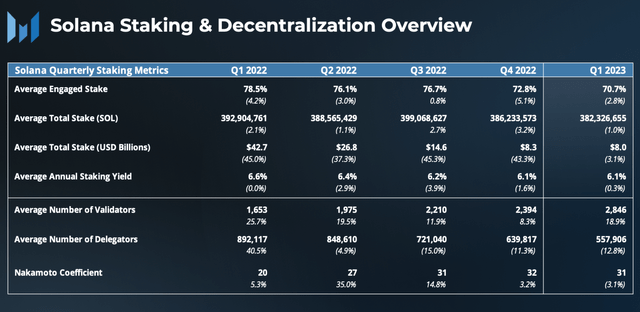

Solana Foundation

Messari

I developed a scoring system that broadly rates blockchain projects. Solana is amongst the highest-rated project – factors are summarized below:

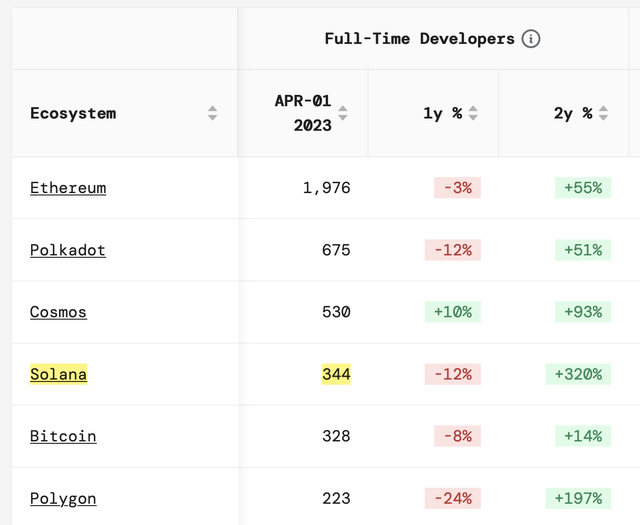

Electric Capital

Electric Capital

Solana Foundation

Solana Foundation

Solana Foundation

Solana Foundation

InvestAnswers

InvestAnswers

Solana’s name comes from the beach near Qualcomm’s headquarters. However, life for Solana has been ANYTHING but a beach. The FTX (and Alameda hedge fund co-founded by Sam Bankman-Fried (SBF)) failure left Solana for dead. Below I summarize the effects from the FTX fraud:

DeFiLlamma

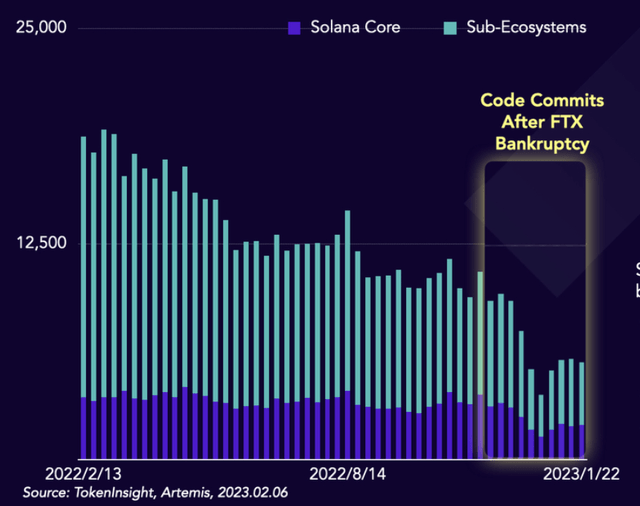

Tokeninsight

DeFiLlamma

Tokeninsight

It’s ironic that the loss of the NFT Dapps was the “final straw” that broke Solana’s back, because Solana’s NFT technologies have been key to its rebirth. To me, Solana’s DNA always felt that it was about connecting consumers rather than the business of finance. Toly himself is a “social connector” who worked at Qualcomm – a company which links people and data. As FTX was collapsing, Solana began making deals with consumer-facing Facebook/Instagram (for NFTs), Google Cloud (its Blockchain Node Engine will allow anyone to setup a Solana node), and Fireblocks (launched support for Solana NFTs and games). And let’s not forget the dog-meme coin named BONK, which was air-dropped into Solana on 1/2023.

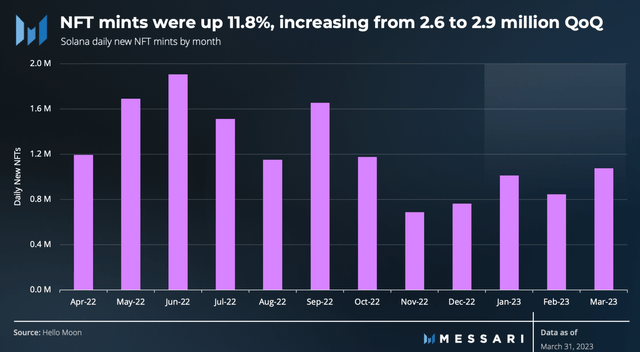

Even non-tech companies like McDonald’s have tested Happy Meal NFTs and ASICs introduced a new running shoe (X Solana UI Collection) which will give owners the chance to win a STEPN-based NFT. Given this momentum, Solana’s NFT volume-growth is greater than Defi, according to analysis by CryptoPotato.

Messari

Messari

There’s a saying that Web3 needs a “killer app” to onboard the next one billion users. In Solana’s case, I believe its “killer app” isn’t an app at all! While Solana’s ecosystem remains mid-sized, I believe its ethos of innovation, as well as the technologies I noted above, will carry the chain to the next level.

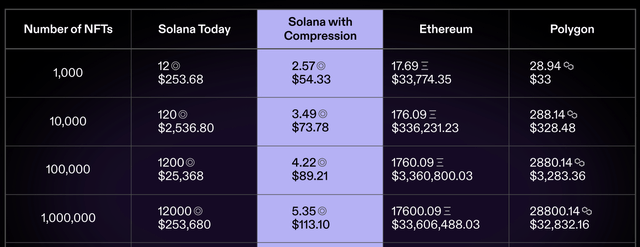

Two recent innovations are Compressed NFTs and the Solana smartphone. Compressed NFTs (co-developed by Metaplex) are NFTs on Solana that store their data in a Merkle tree (think of a digital fingerprint) structure where the Merkle root is on-chain in an account and the Merkle leaves are stored in the Solana ledger (which is off-chain) rather than fully on-chain like conventional NFTs. So who cares? Well, this method allows costs to fall by magnitudes of scale, opening new use-cases for NFTs (see chart). The use-cases are ginormous, including gaming, events, music ticketing (think Ticketmaster) metaverse, enterprise supply chains and personal identity/records.

Solana Foundation

Solana Foundation

On 4/2023, Helium moved from its native blockchain to Solana. Solana’s technology is aptly suited for what’s called “DePIN” – (decentralized physical infrastructure networks) such as wireless, storage and energy networks. Helium provides peer-to-peer Hotspots that creates an internet of things (IOT) and a mobile network. The project said its move was motivated by Solana’s reliability, access to developers, Solana’s network speed and most importantly, compression technology that will sharply lower Helium’s network costs.

Also on 4/2023, Render Network, the first decentralized graphics processing unit (GPU) rendering network (Beeple uses them), voted to migrate from the Ethereum/Polygon platforms to Solana. Render also announced a partnership with Metaplex, so Render will be able to sharply lower costs for its graphically-intense (and real-time) renderings and utilize Solana’s scalability and software developers.

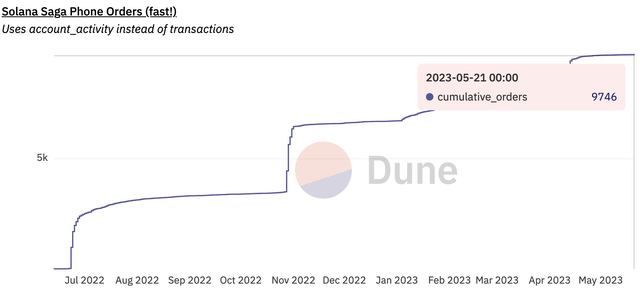

On 5/8/23, Solana announced that consumers will be able to order its new Solana Saga smartphone. Odds are, the Saga won’t be able to compete successfully against the iPhone/Android incumbents. However, a great deal will be learned. Saga features a Mobile Stack that integrates crypto usefulness (think payments) into the phone’s hardware and software. For example, there’s what’s called a Seed-Vault, which stores a user’s private keys in a segregated manner from the rest of the phone’s data, thereby offering heightened protection to the keys. Toly jokes that it’ll have 16 dapps (around the same number Apple had on its first smartphone) in its appropriately name Dapp Store. Solana will undercut Android’s/Apple’s 30% fee as it will not charge ANY fee. I believe that even if the Saga gains a fraction of the smartphone TAM ($479Bn in 2023), it’ll be deemed a success given the large market opportunity. Already, orders have been steadily climbing to 10,000. (See Chart.)

Adheeraj (Dune Analytics)

Adheeraj (Dune Analytics)

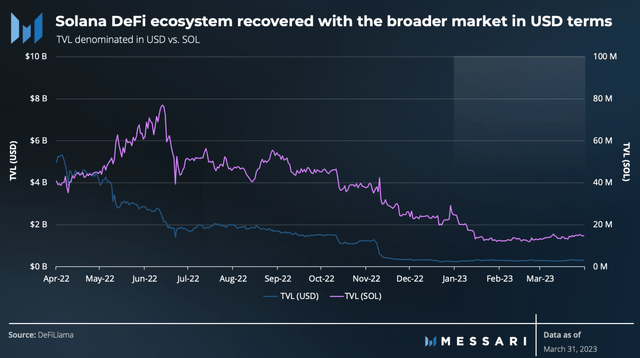

Changes in TVL have been behind strong moves in coin prices, especially when users are dependent on just one third-party data provider – in this case Defi Llama. For example, some TVLs soar from nothing to hundreds of millions due to incentive programs. However, those incentives tend to burn-out quickly – and how do you compare incentive vs. non-incentive (Solana) projects on an apples-to-apples basis ?

In the case of Solana, not all of its ecosystem’s TVL is captured – some of this is due to the high composability of Solana. For example, the Hivemapper, Helium and Render dapps are not in Defi Llama’s dropdown data for Solana. This is especially true when the project has a high proportion of NFT transactions that are participating in Defi. Kamino Finance wrote an article highlighting this very point.

There are several ways you can value crypto projects including: number of active addresses, daily transactions, price/book, price/revenue and price/TVL. However, I believe it’s too early to use these metrics as crypto projects are analogous to venture capital portfolio companies which have minimal revenue-bases. As I mentioned with TVL, several of the metrics can be incorrect. Prior to FTX, I thought Solana was somewhat undervalued using price to book value. I assumed that its huge treasury was analogous to book value as projects are debt-free. But with the FTX blowup, so too has Solana’s treasury.

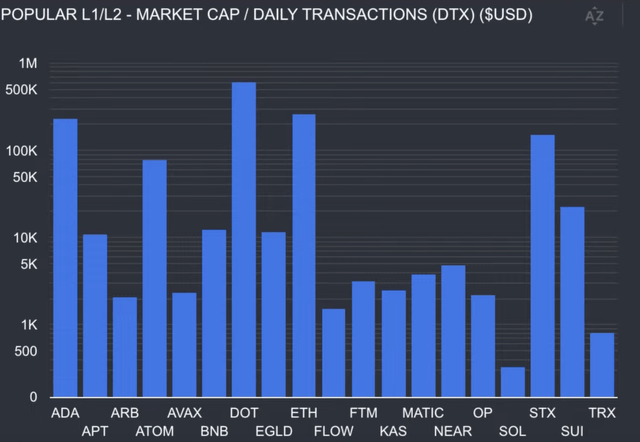

Given Solana’s high exposure to NFTs, I believe using Market Cap/Daily Transactions (the lower the number the better) could be the best valuation strategy (see Chart below). Using Market Cap/Active Addresses yields similar results, with Solana being one of the most undervalued compared to its peers, at under $20,000/address. The closest peer is Near Protocol which is double that amount.

InvestAnswers

InvestAnswers

I believe the cryptocurrency space is inefficient (asset prices do not accurately reflect fundamentals). Once you’ve done the hard work of finding a good project, technical analysis can be used as a timing tool. I believe that Bitcoin is overbought and that the global macro situation of tightening liquidity does not support higher prices for all crypto including Solana.

Further, increased regulatory scrutiny of Altcoins and Stablecoins may increase Bitcoin’s Dominance (i.e., market share of Bitcoin vs the total crypto market) causing Altcoins to “bleed” against Bitcoin. See Sol/Bitcoin Chart.

Trading View

Trading View

Ethereum’s issues with speed/scalability and long upgrade cycle, leaves the door open for new L1s like Solana to capture market share. As such, a DCA accumulation strategy would be recommended on Solana. So, if the old Facebook could “move fast and break things” a reborn Solana could certainly “eat glass.” Enjoy the ride!

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SOL-USD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.